Pennsylvania Medical Insurance

Expenses for Business Use of Your Home - Home Business ...

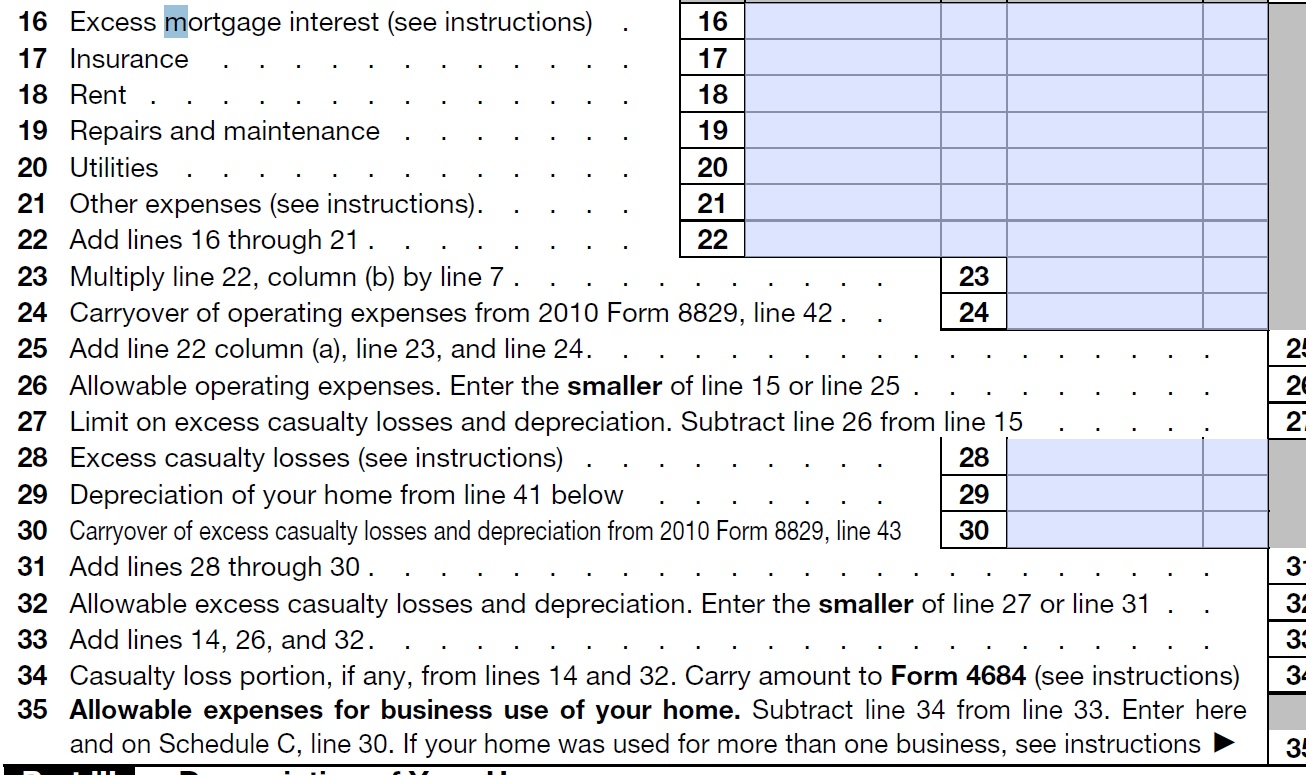

Excess Mortgage Interest . deductions carried over from the previous year and excess casualty losses and . Distinguish direct expenses from indirect ones.

http://biztaxlaw.about.com/od/businessincometaxforms/ht/form8829.htm

Business Use of Your Home - What expenses can be deducted?

Indirect Expenses are those expenses that are paid for keeping up and running your . Casualty losses; Mortgage interest; Real estate taxes; Excess mortgage .

http://www.taxslayer.com/support/205/Business-Use-of-Your-Home--What-expenses-can-be-deducted

Organizer Blank Forms - RedSun Bookkeeping & Tax Services LLC

Excess mortgage interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other indirect expenses: DIRECT EXPENSES. Mortgage interest.

http://www.redsunservices.com/2011%20SCHEDULE%20C%20INCLUDING%20VEHICLE%20AND%20BIZ%20USE%20OF%20HOME.pdf

You have just found your Health Benefit solution

Form 8829 - Internal Revenue Service

Excess mortgage interest (see instructions). 17. Insurance. 18 . (b) Indirect expenses. 19 . Carryover of excess casualty losses and depreciation from 1990. 30 .

http://www.irs.gov/pub/irs-prior/f8829--1991.pdf

Form 8829 - Internal Revenue Service

(b) Indirect expenses . 16 Excess mortgage interest (see instructions) . . 30 Carryover of excess casualty losses and depreciation from 2010 Form 8829, line .

http://www.irs.gov/pub/irs-pdf/f8829.pdf

indirect excess mortgage interest Benefits Savings

Individual Converted Items (1040)

Indirect Expenses: Excess Mortgage Interest. Indirect Expenses: Other Expenses. Direct Expenses: Mortgage Interest. Direct Expenses: Real Estate Taxes .

http://http-download.intuit.com/http.intuit/CMO/proadvisor/ito/pdf/TaxWiseConvertedItems.pdf

Excellent Health Benefits

Individual Items to Note (1040)

Indirect Expenses: Excess Mortgage Interest. Indirect Expenses: Other Expenses. Direct Expenses: Mortgage Interest. Direct Expenses: Real Estate Taxes .

http://http-download.intuit.com/http.intuit/CMO/proadvisor/ito/pdf/TaxWorksConvertedItems.pdf

Tailored Employee Portal

2011 Organizer

Home mortgage interest and points paid: Home mortgage interest not on Form 1098 (include name, SSN, & address of payee): . Excess mortgage interest . . NOTE:Indirect expenses are related to operating or maintaining the dwelling unit.

http://www.wficpas.com/forms/2011/2011-Organizer.pdf

Comprehensive Service

Organizer Blank Forms

Mortgage interest (paid to banks, etc.) . . Excess mortgage interest . . NOTE: Indirect expenses are related to operating or maintaining the dwelling unit.

http://www.bayergraff.com/pdf/2011RentalPropertyTaxOrganizer.pdf

Why You Should Work with Us

FreeTaxUSAŽ - Schedule C Form Instructions

What is Excess Mortgage Interest? . premiums you deduct on Schedule A is limited, enter the part of the excess that qualifies as a direct or indirect expense.

http://www.freetaxusa.com/display_faq.jsp?title=Schedule%20C%20Form%20Instructions&faq_id=1111,1112,1113,1114,1115,1116,1117,1118,1119,1120,1121,1122,1123,1125,1126,1127,1128,1129,1130,1131,1132,1133,1134,1140,1141,1143,1144,1145,1493,1650,1655,1763

Organizer Blank Forms - E. Samuel Wheeler, CPA

Excess mortgage interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other indirect expenses: DIRECT EXPENSES. NOTE: Direct expenses benefit .

http://www.samwheelercpa.com/images/ItemizedDeductionsBusinesUseofHomeOrganizerBlankFormsconverte.pdf

Carriers We Represent

IRS Publication 587, Part 2 - Figure Your Allowable Deduction ...

Multiply your total indirect expenses (line 8, column (b)) by the business percentage . (If you are an employee, do not enter any excess home mortgage interest.) .

http://www.smallbusinessnotes.com/small-business-resources/irs-publication-587-part-2-figure-your-allowable-deduction.html

Here are some of the carriers we work with:

- Aetna

- Golden Rule

- Health American

- IBX

How We Save You Money

DEDUCTIONS FOR - Gonzalez CPA

income in excess of $950, or total investment income in excess of $1900? lil. E. INCOME . Excess mortgage interest . INDIRECT EXPENSES (continued) .

http://gonzalezcpa.com/wp-content/uploads/2012/04/GCPA-2011-Tax-Organizer.pdf

Home mortgage interest deduction - Wikipedia, the free encyclopedia

An indirect method for making interest on mortgage for personal residence tax . exceed the standard deduction (otherwise, itemization would not reduce tax).

http://en.wikipedia.org/wiki/Home_mortgage_interest_deduction

How to Figure Your Home Office Expense Deduction

. estate taxes, mortgage interest, mortgage insurance premiums, and casualty losses . Any excess of these otherwise nondeductible indirect expenses over .

http://www.cpa-connecticut.com/home-office-deduction.html